Union Finance & Corporate Affairs Minister Nirmala Sitharaman here today announced a slew of measures to provide relief to diverse sectors affected by the 2nd wave of COVID-19 pandemic. The measures announced also aim to prepare the health systems for emergency response and provide impetus for growth and employment. Union Minister of State for Finance & Corporate Affairs Anurag Singh Thakur; Finance Secretary Dr T.V. Somanathan; Secretary, DFS, Debashish Panda and Secretary, Revenue, Shri Tarun Bajaj were also present during the announcement of the relief package.

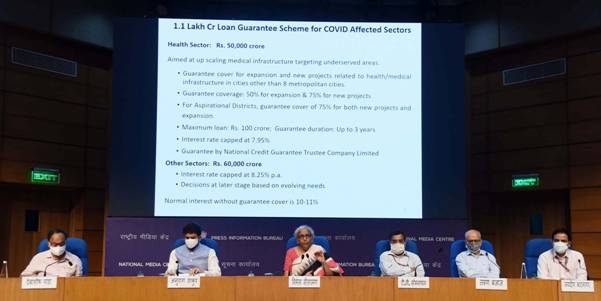

Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman announces economic relief package in New Delhi today.

A total of 17 measures amounting to Rs. 6,28,993 crore were announced. These included two measures announced earlier, i.e. the additional Subsidy for DAP & P&K fertilizers, and extension of Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) from May to November, 2021.

The measures announced today can be clubbed into 3 broad categories:-

- Economic Relief from Pandemic

- Strengthening Public Health

- Impetus for Growth & Employment

- Economic relief from Pandemic

Eight out of 17 schemes announced here today aim at providing economic relief to people and businesses affected by the COVID-19 pandemic. Special focus is on health and reviving travel, tourism sectors.

- 1.10 lakh crore Loan Guarantee Scheme for COVID Affected sectors

Under this new scheme, additional credit of Rs 1.1 lakh crore will flow to the businesses. This includes Rs 50,000 crore for health sector and Rs 60,000 crore for other sectors, including tourism.

The health sector component is aimed at up scaling medical infrastructure targeting underserved areas. Guarantee cover will be available both for expansion and new projects related to health/medical infrastructure in cities other than 8 metropolitan cities. While the guarantee cover will be 50% for expansion & 75% for new projects. In case of aspirational districts, the guarantee cover of 75% will be available for both new projects and expansion. Maximum loan admissible under the scheme is Rs. 100 crore and guarantee duration is up to 3 years. Banks can charge a maximum interest of 7.95% on these loans. Loans for other sectors will be available with an interest cap of 8.25% p.a. Thus the loans available under the scheme will be much cheaper compared to the normal interest rates without guarantee of 10-11%.

- Emergency Credit Line Guarantee Scheme (ECLGS)

The government has decided to expand the Emergency Credit Line Guarantee Scheme (ECLGS), launched as part of Aatma Nirbhar Bharat Package in May, 2020, by Rs 1.5 lakh crore. ECLGS has got a very warm response with Rs 2.73 lakh crore being sanctioned and Rs 2.10 lakh crore already disbursed under the scheme. Under the expanded scheme, limit of admissible guarantee and loan amount is proposed to be increased above existing level of 20% of outstanding on each loan. Sector wise details will be finalized as per evolving needs. The overall cap of admissible guarantee is thus raised from Rs. 3 lakh crore to Rs. 4.5 lakh crore

- Credit Guarantee Scheme for Micro Finance Institutions

This is a completely new scheme announced today which aims to benefit the smallest of the borrowers who are served by the network of Micro Finance Institutions. Guarantee will be provided to Scheduled Commercial Banks for loans to new or existing NBFC-MFIs or MFIs for on lending upto Rs 1.25 lakh to approximately 25 lakh small borrowers. Loans from banks to be capped at MCLR plus 2%. Maximum loan tenure will be 3 years, and 80% of assistance to be used by MFI for incremental lending. Interest rates will be at least 2% below maximum rate prescribed by RBI. The scheme focuses on new lending, and not on repayment of old loans. MFIs will lend to the borrowers in line with extant RBI guidelines such as number of lenders, borrower to be member of JLG, ceiling on household income & debt. Another feature of the scheme is that all borrowers (including defaulters upto 89 days) will be eligible. Guarantee cover will be available for funding provided by MLIs to MFIs/NBFC-MFIs till March 31, 2022 or till guarantees for an amount of Rs. 7,500 crore are issued, whichever is earlier. Guarantee will be provided upto 75% of default amount for upto 3 years through National Credit Guarantee Trustee Company (NCGTC)

No guarantee fee to be charged by NCGTC under the scheme.

- Scheme for Tourists guides/ stakeholders

Another new scheme announced today aims at providing relief to people working in tourism sector. Under new Loan Guarantee Scheme for COVID-affected sectors, working capital/personal loans will be provided to people in tourism sector to discharge liabilities and restart businesses impacted due to COVID-19 pandemic. The scheme will cover 10,700 Regional Level Tourist Guides recognised by Ministry of Tourism and Tourist Guides recognised by the State Governments; and about 1,000 Travel and Tourism Stakeholders (TTS) recognized by Ministry of Tourism. TTS’s will be eligible to get a loan upto Rs. 10 lakh each while tourist guides can avail loan upto Rs 1 lakh each. There will be no processing charges, waiver of foreclosure/prepayment charges and no requirement of additional collateral. Scheme to be administered by the Ministry of Tourism through NCGTC.

- Free one month tourist visa to 5 lakh tourists

This is another scheme aimed at boosting the tourism sector. It envisages that once Visa issuance is restarted, the first 5 lakh Tourists Visas will be issued visa-free of charge to visit India. However, the benefit will be available only once per tourist. The facility will be applicable till 31st March 2022 or till 5 lakh visas are issued, whichever is earlier. The total financial implications of the scheme to the government will be Rs 100 crore.